Pak-Sun Ting, founder of Votee, about the challenges and opportunities in AI, particularly for low-resource languages. Pak shares his journey from a stable banking career to entrepreneurship, discussing the importance of partnerships, and understanding the peculiarities of building a startup in Hong Kong. The conversation goes into the significance of localised language models, the fundraising landscape, and the future of technology in bridging cultural divides.

Takeaways

Votee aims to revolutionise AI adoption in Asia and Africa.

There is a significant digital divide in access to AI tools.

Pak Ting left a comfortable banking job driven by idealism and innovation.

Entrepreneurs must know when to pivot or quit.

Hong Kong's startup ecosystem faces unique challenges due to high costs.

Localised language models are crucial for effective communication.

Partnerships are essential for startup success in the current landscape.

The future of AI holds both opportunities and challenges.

Cultural preservation is a key aspect of Votee's mission.

Success in entrepreneurship is defined by impact and revenue.

Chapters

00:00 Introduction and Pitch

01:06 Revolutionizing Enterprise AI Adoption

03:14 Leaving a Comfortable Job to Become an Entrepreneur

05:49 The Mindset of Founders and the Notion of Failure

10:05 Knowing When to Quit or Pivot

10:50 Startup Landscape in Asia

16:56 The Importance of Language Models for Low Resource Languages

20:35 Advantages of Training Language Models for Specific Languages

24:49 Potential Consolidation in the AI Space

29:13 Fundraising Success and Revenue Generation

32:23 Advice for Early Stage Startups

39:34 The Future Outlook: Innovation and Positive Change

Visit our website to learn more about our work with Asia's leading tech startups.

- (00:00) - The pitch

- (01:06) - Revolutionizing Enterprise AI Adoption

- (03:14) - Leaving a Comfortable Job to Become an Entrepreneur

- (05:49) - The Mindset of Founders and the Notion of Failure

- (10:05) - Knowing When to Quit or Pivot

- (10:50) - Startup Landscape in Asia

- (16:56) - The Importance of Language Models for Low Resource Languages

- (20:35) - Advantages of Training Language Models for Specific Languages

- (24:49) - Potential Consolidation in the AI Space

- (29:13) - Fundraising Success and Revenue Generation

- (32:23) - Advice for Early Stage Startups

- (39:34) - The Future Outlook: Innovation and Positive Change

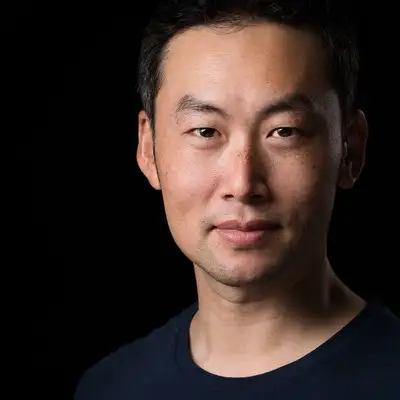

Creators and Guests

What is Unsensible - The Asian Startup Podcast?

BRAVE SOULS WANTED.

Failure almost certain. Attempting is unwise.

Far east adventure. Success is changing the world.

Join us on the Unsensible podcast where we talk to the Asian startups and their ecosystem partners who are intent on changing the world.

Jonathan Nguyen: Welcome back to

another episode of the

Unsensible Podcast, where we

speak to the lunatics who defy

their Asian parents to go on to

become entrepreneurs instead of

doctors.

And today's unsensible lunatic

is none other than Pak Ting, who

has a startup called Votiai Pak

.

How are you and glad to have

you on the show.

Pak-Sun Ting: Yeah, I'm good.

Thanks for inviting me to the

show.

I'm excited.

Jonathan Nguyen: Well, I'm not

going to do a long intro because

I know you're in the midst of

fundraising, so I'm just going

to throw it to you to pitch and

your 30 seconds starts right now

.

Pak-Sun Ting: Yeah, so I'm

building.

What we're building is we're

looking to revolutionize

enterprise AI adoption for Asia

and Africa.

So essentially what that means

is that if you look at sort of

the big large language models,

what they tackle is English or

Mandarin, but there's over 6,000

languages.

There's a big digital divide.

We call it the AI haves and the

AI have-nots.

So we're looking to provide

that with both the base model

for low resource languages, and

then we start to build

applications on top of that to

enable this digital enablement

or AI enablement, into places

that are kind of behind this

whole curve, AI curve.

Jonathan Nguyen: Amazing.

So what happens if you succeed,

If it all goes well?

What are the broader

implications for this?

Pak-Sun Ting: Well, I think

maybe kind of reverse that

question.

If we don't succeed, or if we

don't tackle this problem,

what's going to happen is that

you're going to have sort of the

capitalism of the digital world

.

You'll have people with a lot

of access to productivity tools

so that they can just focus on

learning, understanding,

creating, and then you have the

space which is sort of unlit.

There's no AI tools.

They're still focusing on

ensuring that paperwork is being

done in a proper way, and so on

and so forth.

So if you kind of look at that

picture, that's 10% versus 90%

of the world.

And if I answer your question,

the original question what would

happen is you'll have less of a

gap.

You know there's the UNDP.

They have this thing about the

digital divide and how this gap

requires a bridge.

So companies like us, we see

this as an opportunity, we see

this as big impact, and so if we

do this well, in five years

then I think the world would be

a lot more connected.

Culture preservation is on the

table as well.

Identity, you know, languages

that could be lost can now be

saved.

So I see sort of the again,

people who speak low resource

languages.

Their culture could be uploaded

onto the grid per se.

Jonathan Nguyen: That's awesome.

So we're going to go deeper

into this in a second, but I

want to understand why did you,

from what I understand of your

background, you left a very

comfortable banking job.

Yeah, what made you do that, to

go and do this?

Pak-Sun Ting: yeah.

So I get a lot of that,

especially when I was about to

get married, you know, with my

in-laws, you know, on a

day-to-day basis, my parents, my

mom.

I think it's a myriad of

factors that kind of pushed me

into this.

The first is idealism.

So I think that there's three

things that can change the this.

The first is idealism.

So I think that there's three

things that can change the world

.

The first is capitalism, the

second is innovation and the

third is regulation.

So this is sort of my second

chapter of my life, if you will.

Number two is I thought I can,

I thought it was easy.

I think a lot of founders who

kind of go into this believe

that they have this superpower,

and I was one of those

knuckleheads thinking I could do

that.

I went in thinking that my

banking experience will well

equip me for anything that's to

come.

So that was the second reason.

The third reason is going,

which goes back to the first

reason is you really see that

there is a need for further

innovation.

You feel that your innovation

can be, because it's your own

baby, you can control it and

therefore you can make sort of

the best impact you can, and I

think that was a lot of that as

well.

So those three things, coupled

with, you know, meeting the

right co-founder, I think helped

a lot for me to kind of take

that step.

Jonathan Nguyen: Yeah, we've

spoken a few times now, and

every time we speak, I'm

reminded that you started a

company and a very young family

at around about the same time,

correct, um?

Pak-Sun Ting: yeah, so I I guess

the the other sort of big

factor is my wife was supportive

so I couldn't leave that one

out, but yeah, so she was very

supportive and that allowed me

to kind of do this as well.

Jonathan Nguyen: And you

mentioned.

You know there's always.

See, I always think founders

are delusional, myself included.

You have to have some element

of like well, I'm going to defy

the odds like you know, the 90%

failure rate and everything else

.

Going to defy the odds like you

know, the 90% failure rate and

everything else, and I can fly

close to the sun.

I get a sense from a lot of

founders that also failure is

not an option.

What do you think about that

statement?

Pak-Sun Ting: I think it's

dangerous in certain contexts.

I know people who have

mortgaged their houses.

In certain contexts, I know

people who have mortgaged their

houses young families as well

quit their jobs to do something

that they believed they could

and they took that statement too

, took it really seriously, and

they continued doing that and

jeopardizing a lot of things.

I think that's part of it.

I believe it.

I believe that when you go in,

there's a saying in Chinese the

general goes into battle, cuts

off his boat so that there's no

turn.

So you kind of have to have

that mindset to go in and.

I think you, you have to have

that mindset, brother, but you

can't have that consistently,

especially when, in the face of

youeconomics family situation,

you have to pivot, and sometimes

pivot means going back to the

corporate world.

So I believe in that statement

and you have to have it, but you

can't stick with it for too

long.

Jonathan Nguyen: But how do you

know when to quit or pivot?

Like I spoke to Justin from

Gents Technologies and he was

saying that you know, when he at

one point, although he had all

this government funding it took

a long time for it to come

through and at one point he

looked at all of his bank

accounts and he had 300 Hongong

kong dollars in there and he

just, you know, gritted his

teeth and like knuckled in, like

at what point do you say I'm

gonna pull the ripcord?

Pak-Sun Ting: yeah, it's a good

question and there's no, there's

no rule of thumb and there's no

sort of um metric, that that

you kind of have to look at to

see when you should quit.

For me, for some people it's

bank account, for some people

it's their families, for some

people it's their health.

I think, for me my sort of red

lines, or sort of what you call

pillars.

If they get knocked down, I'm

out.

You know, and this includes,

you know, family for sure, right

.

Number two is, you know your

co-founders, right.

So having a very good

co-founder also kind of, you

know, putting that sort of same

persistence, um, and if he quits

, you know, I think that's a big

sign and I think, uh, third,

economics is obviously, you know

, one big thing that you know

dictates both your family's

lifestyle, your own lifestyle,

your own health, health is

another one.

So I think if you take all four

, sometimes your health health

is okay and co-founder is good,

but your family is kind of

telling you to kind of stop.

Do you stop then?

So I think it's just a

combination of things and if

they're all sort of kind of

healthy, healthy sort of levels,

it's okay to continue to run

with it.

Everyone's different.

Some people don't have families

, some people don't have

co-founders, so what kind of

levers do you look at?

Some people don't have families

, some people don't have

co-founders, so so what kind of

levers you look at?

Some people don't care about

their lifestyle.

So I think you know, then you

have to kind of look at external

uh signals, like you know, what

are people saying about their

business?

Are people using it?

Is funding coming in?

So I think in your example of

gents if it was gents, you know,

maybe he had.

Maybe he had no money in the

bank account, but he was certain

he was going to get that

paycheck and VCs were backing

him.

Or if it wasn't, maybe his wife

is backing him.

So who knows?

I think everyone's different,

but those are my sort of pillars

, if you will, for me to kind of

continue fighting the

entrepreneur journey.

The good fight, yeah, good

fight.

Jonathan Nguyen: So I mean on

that note, I think there is a

what I've noticed amongst the

founders here in APAC a lot of

them are you know.

The Silicon Valley story is

that you know you drop out of

university and then go and do

this startup and suddenly become

an unicorn.

It's certainly the mythology.

It's certainly not the truth.

In most cases In Asia.

What I've noticed is that

founders are a little bit older.

There may be career changes.

Maybe they've had a career and

then have spotted an opportunity

.

In your case it certainly seems

like the case.

Is that what your read is as

well?

Pak-Sun Ting: You must come

across a lot.

Yeah, I have this, talk a lot

with people, with regulators,

with VCs, with founders

themselves as well, and I think

the common denominator is that

it's very expensive in Hong Kong

to start something.

So typically people I used to

work in banking and with my

savings I was able to kind of

come out and bootstrap you know

the first half of the game.

So I could do that here If I

was a startup vendor in Hong

Kong.

The other thing that's lacking

is the risk capital for seed,

stage and pre-a companies.

So that's another sort of sort

of I guess thing that is missing

in Hong Kong.

I'm not sure for Asia, but I

think definitely for Hong Kong,

and so when you're a youngster,

I mentor a young in as well.

He he's 19 and living conditions

aren't the best.

He's a smart kid, doesn't have

access to capital, has dreams,

but there's no sort of

foundation or there's no

infrastructure for people to

kind of get funding for early

stage ideas, whereas in the US,

you know, yc is a big thing and

there's all these seed stage

companies or seed stage VCs.

So I think that helps a lot.

And again, I think the other

pain point again is just how

expensive it is in Hong Kong.

Jonathan Nguyen: Yeah, it's

interesting, you say that just

how expensive it is in Hong Kong

.

Yeah, it's interesting you say

that A friend of mine used to

work in a family office for,

let's say, one of the biggest

family offices in Hong Kong and

her perspective, having worked

there for a long time, is that

in Hong Kong, certainly, the

idea of investing in a startup

is getting someone to get you an

allocation of ByteDance.

It's not so much early stage.

Is that your read as well?

Having just gone through the

rounds.

Pak-Sun Ting: Yeah, 100%.

I think if you kind of look at

people, sort of gatekeepers or

sort of what they call second

generation, third generation

they've made their money through

property.

They've made their money

through sort of the big leagues

stocks, bonds maybe but in

startups there's not a lot.

How many startups can someone

name?

Name?

How many startups are based in

hong kong that are actually

global?

There's not a lot, and I think

that's not just because of the

seed stage missing, and it's not

because the parents in hong

kong are a little bit more

practical in some sense.

Uh, I think the other big thing,

though, is, you know, hong kong

has a very captive 7 million

audience.

So when you want to grow this

into a sort of a global thing,

it's not easy, and so you you do

a very successful start in Hong

Kong, your markets capped just

because of the nature of Hong

Kong being the size of 7-8

million people.

You can't just kind of take

Hong Kong's model and say, hey,

we're going to do that exact

same thing in ASEAN or China,

because they have very different

behaviors.

So we're kind of left with this

thing where you're capped,

can't really scale, can't really

just say I want to do other

markets because I've done it in

Hong Kong and we're successful.

I think there's that as well,

because I've done it in Hong

Kong and we're successful.

Jonathan Nguyen: I think there's

that as well.

I think it's going to be a

general Asia problem and I think

we're going to get to this in

just a second.

Sure Is that you know if you're

a successful Vietnamese company

.

So I've talked to a lot of

Vietnamese startups recently and

their worldview is that, you

know, ho Chi Minh and Hanoi are

two separate markets and their

total addressable markets that

I've seen are like $30 million.

They don't see a world outside

of Vietnam.

Okay, even though they have a

population of 80, 90 million

people here.

And I think it's the same.

If you're an Indonesian company

, how do you escape Bahasa,

especially if you're software

right?

Pak-Sun Ting: There's very few

Asia pan-Asia success stories,

aside from I guess Grab,

lalamove, gogo, all kind, all

vehicle and transport logistics

related type of things yeah, if

people in Vietnam see Ho Chi

Minh as Ho Chi Minh and Hanoi as

Hanoi, and they find that it's

hard to scale towards those

cities north or south, imagine

Hong Kong.

It's even worse so if they have

thatong right, yeah, it's even.

It's even worse so.

I if, if they have that problem

yeah, you know it's, it's uh,

they don't know, but you know,

that kind of puts hong kong even

at a sort of a back foot.

You know, because hong kong is

hong kong is hong kong.

We developed the first

cantonese large language model

just for hong kong, just because

it's so different.

The culture is very different.

The way they speak is different

than people who speak in

Shenzhen.

They speak Cantonese as well,

but the lingo is different.

So Hong Kong is just a unique

place.

It's an awesome place, but it

also limits somewhat the market

as well.

I shouldn't be saying that,

because maybe investors are

listening to that as well but

there's that for sure.

Jonathan Nguyen: So actually

that's a good segue, because my

next question for you is it

seems to be this trend in tech

that Silicon Valley is this

heart of innovation.

Everyone thinks, if you made it

in Silicon Valley, you made it,

but that's a very Silicon

Valley-centric view of the world

.

Right In the last, like tech

evolution that everyone is

probably familiar with is

probably the social media

evolution.

And, yes, there are a lot of

big platforms that came and went

.

Some are still around, like

Meta, but they're far from being

truly global.

So in asia we have like wechat.

It's enormous for china.

In japan and thailand they use

line.

In korea, the cow.

Yeah, you've come up with a

cantonese llm and your objective

is now to look at other low

population languages, low

resource languages, rather Low

resource languages, right?

So just to kind of Tell us a

bit more about that.

Pak-Sun Ting: Sure, just to

quickly define so, low resource

essentially means that there's

not enough data online to train

a language, right?

So, for example, if you look at

Cantonese, there's over 80

million people that speak

Cantonese, but there's not

enough data online to train that

.

You look into African languages

like Chihuahua it's super low

resource.

It's only spoken in a few

countries.

So you have these places where

it's going to be.

You know, low resource, uh, not

necessarily low population.

Uh, if you look at, uh,

indonesia, there's apparently

700 different languages in

daleks in indonesia itself, big

one being bahasa, 210 million

people who speak it.

But that's kind of considered

low resource as well.

So so that, well, so that's

where we see the opportunity.

When we did Cantonese, it's

native to us, we have the data

sets, we have a market research,

we have a big data platform,

social listing and so on and so

forth, so we were able to do

that and train that right away.

For Indonesia, we also have the

same sort of platform, we also

have the same sort of data sets,

because we do market research

out of Indonesia, for instance,

and so we have a lot of data

sets and we're looking to kind

of train that as well.

So we look at multiple

benchmarks.

If it's, for example, a low

resource language that's spoken

with by 100,000 people, now

that's hard right, so we won't

go into that market.

We might do it for impact

reasons or for heritage reasons

or cultural preservation reasons

, but not for economics.

We look at the development of

technology in that community.

So, for example, if nobody

actually uses digital tools,

then building an LLM for that

country or for that language

doesn't really work.

So we have to look at the tech

community.

Then we also look at

partnerships.

Right, do we have good partners

?

We're not going to go in, you

know, openai or Google or Amazon

or the big guys.

You know they don't even go

into a place by themselves.

So, as a startup, we have to

look at partnerships.

So those are generally the

three things that we kind of

look at.

We also look at GDP per capita.

Now, if it's a very below

$1,000 US, that's also very hard

for for what you would call it

for LMS to be built and then

therefore to be profitable.

So those are the four things

three or four things that we

look at and I think being in

Asia.

There's over 2,000 languages.

I think there's 2,500 languages

plus.

There's lots to pick.

We're still going to perfect

Cantonese first.

We're definitely going to look

at different languages in

Southeast Asia and then also in

Africa as well.

Jonathan Nguyen: So tell us.

We get LPs listening.

Sometimes they're not the

deepest.

They have an interest, but

they're not the deepest in the

AI space.

What is the advantage of

training an LLM completely on

Cantonese, and how would it

differ from someone deploying a

model from OpenAI?

Pak-Sun Ting: So if you look at

OpenAI, you know let's just say,

100% of their text I think it's

somewhere between 50% to 55% is

based on English, 10% is based

on Mandarin.

Now, mandarin, chinese,

Cantonese they're somewhat

fungible in some sense.

So when you take OpenAI, for

instance, and then you translate

it back to Cantonese or

different languages, some

estimates have put it that the

accuracy rate is below 60%.

So that's not acceptable.

It's not acceptable not just by

consumer level, but definitely

by governments, banks,

corporates and so on and so

forth.

Cantonese is very much a spoken

language, right, so I would say

things in a certain way, but

when I type it's also a very

different way.

So then you go why do you need

a Cantonese LLM?

Then you know why does it need

to understand spoken language?

Because if you look at LLMs,

you know.

I really, truly believe that

this is the next sort of

building block that changes the

way we do things.

Call centers, for example.

Let's say, if you have virtual

receptionist, virtual agents,

you're not going to talk to a

virtual agent, but then it talks

to you as if they're reading a

textbook.

You want them to talk to you as

if you're talking to a person

and vice versa the machine or

the virtual receptionist needs

to understand your spoken

Cantonese.

So the next step for a large

language model is large

multimodal model.

So it's multimodality you can

see, you can listen, and so

that's where Cantonese as a LLM

becomes very, very useful and

it's not far in the future.

We're building POCs for that.

As we speak, you'll see it in

chatbots, for example.

You know you talk to, let's say

, cathay Pacific, or let's say

you talk to a bank, you're

talking to an AI, but do you

want the AI to really understand

natural language?

Yeah, of course.

So that's where LLMs come in

and again, this is also sort of

the building blocks for large

multimodal models LLMs, so very

useful.

Hong Kong's GDP is 93% service

sector, so GPT is good for

services.

So if you look at Hong Kong's

GDP let's just call it 400

billion US dollars or 500

billion US dollars 90% of that

can be affected by a large

language model for that language

, for that localized language.

So a lot of use cases.

I think it's easily $100

billion TAM in Hong Kong, so big

enough for us.

And obviously we have a

blueprint, a roadmap towards

different languages as well, and

so I think, again, by building

this and having the know-how, we

can just kind of take what

we've built in Hong Kong and

kind of change language, change

the settings, change a little

bit of fine-tuning, apply it to

baseball that fits them and boom

, you have another market Highly

scalable.

Jonathan Nguyen: Do you think

then we're going to get some

fragmentation, because in Asia

we have, as you you said, some

2,000 odd languages already?

Do you think there will be more

startups like you trying to

scale out at the same time to do

that?

You know, same task, you know.

Is it a case that maybe there

has to be so many you know

specialists to do this?

Or do you think at some point,

like with everything, there'll

be some kind of consolidation?

Pak-Sun Ting: I think well, one.

I would hope that more people

come out to do this.

You know it's not a one votey

startup thing that we can

accomplish.

You know there's the moore's

law right.

So, as by you know, it's going

to be exponentially cheaper for

you to build or train large

language models, and hopefully

that will invite more people to

come in as well.

So would I see some sort of

consolidation?

Of course, I think if you kind

of look at let's say the

yesteryears, where there's no AI

, there's no sort of that

fragmentation exists.

It's a legacy thing.

We've worked with it, we've

worked around it.

Now there's tools for us to

kind of translate and quickly

understand what they're saying,

culture and all that kind of

stuff.

So there's more communication

in that sense.

So I think with every

consolidation, I think I, if you

kind of put the large language

model, let's say for Myanmar or

let's say for Cantonese, add a

translation tool between that.

In that sense we would kind of

converge in terms of bringing

cultures online, understanding

more of what people think.

So in that sense there's some

sort of consolidation.

I think models can now merge

with different models as long as

it's the same architecture.

Now merge with different models

as long as it's the same

architecture, so you can easily

merge these models and I could

talk to you or I could talk to

your Vietnamese colleague, for

example, and in real time, with

very low latency, understand

what he's talking about and

crack the same jokes and, you

know, laugh together.

I could see that happening.

In that sense there's some sort

of consolidation.

But I think, I think for that

to happen again is going to be a

fear, at least a couple of

years worth of dedication of

understanding data sorry in

terms of data annotation for low

resource, language building it,

training and so and so forth.

But I do see that kind of

converging in some sense, but

not really consolidating, as

like one guy takes all and so on

and so forth.

Jonathan Nguyen: I mean, do you

think, if you kind of achieved

what you set out to achieve

somewhat, do you think one of

the big players like OpenAI or

Google will come and say listen,

we want your IP, we want your

tech, we're just going to

acquire you.

Pak-Sun Ting: Yeah, I think

there's definitely that sort of

you know there's a Google

project called the Moonshot 1000

Languages, and what they want

to do is they want to also help

the 1000 languages, the next

1000 languages.

We're doing the exact same

thing, not exactly 1,000

languages, we're going to do 10

next year, and so we do see that

what we're building is useful

and therefore, by being useful,

there's value.

And if that means acquisition,

does that mean anything else?

That's definitely on the table.

That's not what we really think

about.

We just want to think about the

next pain point in languages

and we want to see can this be

done, can we do it?

And then we take that on rather

than kind of you know, I think

Google, strategically, might go

into Indonesia and therefore

let's do Indonesia so I think.

But we also kind of operate in

the same sort of philosophies.

You know, is it hard to do?

Can you have partnerships and

so on and so forth.

In that sense there's

commonality as well and that

could lead to partnerships.

We talk with Amazon.

For example, amazon's partnered

with us to build the Cantonese

large language model.

We'll be in Vegas at the

reInvent events in December.

And before Amazon we spoke with

Google as well.

And so I think partnerships is

the natural way for me to kind

of think about these big guys

rather than them kind of coming

in and acquiring us.

Jonathan Nguyen: And I mean, on

that note, you've been doing the

rounds of fundraising.

It's a tough time.

Most of the startups I've been

speaking to say, yeah, investors

have said, oh, we're interested

, but no one's actually

deploying.

You're seeing some success.

What do you attribute that to?

Pak-Sun Ting: Well, I attribute

that a lot to the way we're

trying to fundraise.

And two is how we run our

business.

So for the first one, you know,

going to institutional VCs in

Hong Kong again there's that

lack of seed stage, pre-A stage,

so that doesn't really help.

So we kind of went through

connections, individual tickets

as well.

We do have institutional VCs

for this brand, one based in

Hong Kong and the other based in

Europe, so that kind of helped

a lot as well.

Cyreport was a big help.

We're part of CyReport CIP as

well, and so leveraging their

network has been helpful as well

.

So using this kind of sort of

style of approaching investments

, individual tickets, family

offices, infrastructures that

are already set up in Hong Kong

that can help us do that raise.

So I think that was sort of one

part of our success.

The second part is trying to be

profitable right.

So being having building

business, actually deploying our

technology, working with

corporates, banks, governments,

they pay, and in that sense it's

sort of the best way of funding

a company, because you're

building on success, you're

building on a pain point and

they're paying you, so it's

validated and all that money is

not equity, their revenue.

So that helps a lot as well.

So what we've been, we've been

hyper focused on how do we get

revenue, how do we scale revenue

, how do we do partnerships so

that we don't have to build a

big sales team but rather

leverage our partners like

channel sales to kind of do that

.

So it's a lot of infrastructure

building as well, but I would

say those two sort of really

helped us.

You know, get that quote

unquote success.

We're not successful yet, but

we did close a sort of mini

round and again, revenue is

something that a lot of VCs look

at as well.

So having that was helpful for

sure.

Jonathan Nguyen: So I mentor on

the Founder Institute program,

amongst a couple of others, but

they're very early stage and

there is in the Hong Kong cohort

this year there is probably

10-15 startups and at a very

early stage.

Right if right, if you could

give them.

They're at the point where

they've written their business

plan, they've just incorporated

and they have a pitch deck.

If you could tell your younger

self, as these people are at

this point in their journey,

what was something that you

definitely wouldn't do again.

Don't do the whole thing.

Pak-Sun Ting: Go back to the

bank job just check the box and

go back there.

Yeah, so what?

Jonathan Nguyen: what would you

do?

What would?

What would you do differently?

That you would advise and

counsel, you know, knowing that

all walks of life are going to

be different, right, right, but

reflect on that a bit.

Pak-Sun Ting: Yeah, I think,

yeah, I'm not sure.

Actually, I think what it would

tell my younger self or younger

cohorts is that you know the

usual cliched stuff which is

it's a long journey, da, da, da,

da, and all that kind of stuff.

I would say, think about

partnerships.

You know, let's say, in poker

you have ace of whatever, ace of

spades or whatnot.

If the other person has ace of

hearts, he ace of clubs, he has

ace of diamonds.

You partner up.

You can beat 90 on the table,

probably more I don't know what

the stats are, but you can beat

almost a lot of hands out there.

So partnership is one big thing

.

One thing I found that when I

speak to founders they always

feel that they have this amazing

idea and they don't want to

share it with anybody.

They want to develop it and

then they want to go to market.

I say validate that, go through

, talk to people, talk to other

founders who are looking to kind

of hit the same pain point.

And then collaboration If

there's a collaboration

opportunity, definitely go for

it.

Going alone I guess this goes

back to what you were saying

being in this sort of founder's

uh journey is a very lonely sort

of uh, you know, walk and it's

it's uh, it's very emotional.

So I think having somebody who

you can pair up with, that have

the same vibe, have the same

values, wants to attack the same

pain point, those are

potentially your co-founder.

So collaboration leads to

potentially finding a

co-founding team and so on and

so forth.

So I think that's what I would

advise myself.

I was that kind of guy where.

Not that I was sort of

secretive about what we're

building, but I didn't know that

talking to people actually

could lead to a better outcome.

Focus on small tickets.

Some people kind of want to go

for the big tickets and probably

try and do this somewhere else

other than Hong Kong.

Jonathan Nguyen: Maybe that's

the other example suggestion.

Yeah, I think I mean in terms

of scale, it's tricky.

Hong Kong is a tricky place,

but also, you know what I

noticed?

I was mentoring on the Founder

Institute Japan program and they

had a very high number of

female founders and they came up

with some ideas that absolutely

wouldn't have been credible, or

, you know, I don't think a man

would have arrived at the the

same conclusion.

So, being in hong kong and from

hong kong, you're going to come

up with solutions that aren't

going to be thought of somewhere

else and and maybe that is what

is required, albeit it's not

easy.

Pak-Sun Ting: Yeah, definitely

not easy.

I think the other thing about

Hong Kong too is the corporate

Hong Kong team.

Let's call it that.

They're not as open to

innovation as sort of my

experience in, let's say, canada

or talk to my friends in the

States.

And so I think if you have

corporate Hong Kong again not

sponsoring some of these ideas

by just not adopting it and just

kind of going through the same

sort of vendors, going through

the big listed companies and

making sure that if you go to a

listed company, if they fail,

then at least you can go back to

your boss and say, hey, look,

it's not me, it's them.

I think there's that as well in

Hong Kong.

So there's that sort of

inability to lose or to kind of

fail in that sense.

So I think all in all, there's

that sort of thing that kind of

doesn't make a seed stage

company an easy ride.

But I think if you can get past

that again, partner with guys

like people like CyberCorp.

Jonathan Nguyen: You know

they're there and as long as you

can tap that network.

Pak-Sun Ting: You can leverage

that sort of momentum.

You can probably do maybe big

things.

You know they have a huge

network of people.

So that would be my sort of

response.

Jonathan Nguyen: So you're here

now.

You've got some way to go, I'm

sure If I was to ask you how far

have you got to go?

What does success look like?

Pak-Sun Ting: ago.

What does success look like?

I think success would look like

actually kind of seeing your

technology in scale.

I think that's the easy sort of

answer.

I think success for me

personally would really mean not

worrying about the

month-to-month you know.

Rather it's more like which

market should we look into?

I think I define success quite

traditionally in some sense.

Like you know, are people

talking about you?

Do you have revenue?

Are you able to tap that series

?

You know alphabet soup, you

know A, b, c, d, e.

Are you IPO ready?

To me that's the definition of

success, because that's defined

for me in some sense by taking

outside capital.

But personally I think again,

seeing how that technology, or

hearing case studies, or hearing

people doing testimonies about

saying how this Cantonese LLM or

they were able to learn

Cantonese through Cantonese LLM,

or cut this bank's cost by X

amount.

I think that to me would be the

most resounding, most validating

success.

I would claim.

The most resounding, most

validating success, I would

claim.

But then again, I have that

very traditional definition of

success as well, just again

because of investors.

Jonathan Nguyen: So I used to

ask people, 10 years from now,

what's the ideal future hold?

But I think in this space,

maybe it's just five years is as

far ahead as we can look

because it moves so quickly.

Maybe it's just five years is

as far ahead as we can look

because it moves so quickly.

What do you think is going to

happen in the next five years?

What's the future hold for us?

Pak-Sun Ting: I think I'm

optimistic.

I think the future I'm half

class, full type of guy.

I think the future would be in

a better position, better than

today.

That's my sort of general one

liner, right.

I think it's going to be good.

I think we'll see a lot more

innovation come into play in

different parts of the world,

almost like the smartphone era,

you know, when people, you see a

lot of innovation coming out of

Africa and some parts of Africa

as well, just because of online

teaching, smartphones.

They have all these different

hacks that we would never be

able to apply in our parts of

the world or in North America,

where I was born.

So I see a lot more innovation

coming out.

I see, hopefully, a lot more

people being brought out of

poverty, being able to kind of

work on things that they want to

work on, and I think, with

economics being better, that's

highly correlated or

uncorrelated with conflict,

right.

So the more developed the

country is, the less it's going

to go into internal conflict.

You know, you know there's the

famous Thomas Lieberman, the

McDonald, the Golden Arse theory

.

Obviously, that theory has been

broken, but to a certain point

it was working.

You know, every place that had

a McDonald's didn't have

conflict or didn't go into sort

of a large-scale conflict.

So I see this as being sort of

somewhat the equalizer, if you

will.

But the equalizer moment is

going to happen in the parts of

the world that we don't talk

about as much, and that's what

we want to focus on parts of the

world that we don't talk about

as much, and that's what we want

to focus on.

So no flying cars, no AGI out to

get us.

So I think there is real

concerns about AI in general, or

AGI, and I think the big

concern for me is the

displacement of jobs.

What's going to happen if an

economy suddenly loses 5% or 10%

of the workforce?

That's a real thing.

These people will be out of

jobs.

The government might not be

able to support.

If they do, it's not going to

be at the scale that people want

.

So I think jobs is a real thing

.

I think deep fakes, fraud I

think it's definitely going to

be used for that kind of stuff

as well.

So that's another big thing.

We have the big elections

coming up, so is that going to

be affected in some ways by fake

news?

And fake news is going to be

powered by AI for sure.

So that's not a big concern for

me.

Is it going to create these

robots?

Maybe not.

I'm not as concerned about that

.

Is it going to create viruses

that could harm the world?

I think there's a tail chance

of that happening as well.

So there are concerns for sure.

Flying cars maybe not, yet we'll

see.

You know, there's a company

called ehang that's developing

sort of not drones, but like

self-powered not so far, but

autonomous driving helicopters

that can take two people.

That's happening already and we

saw that in France as well, I

think, at the Olympics.

So I see that.

But I think we're still quite

long away from the existing

major cities.

Newer cities like the new

capital for Indonesia, sure, the

new capital of Korea south of

Seoul, yeah, I think that's

going to happen as well, but not

in Hong Kong, not in New York,

not in Toronto.

So that's my take Next five

years, that is.

Jonathan Nguyen: Any closing

words for?

Pak-Sun Ting: us.

Jonathan Nguyen: Next five years

, that is.

Pak-Sun Ting: Any closing words

for us?

No, I'm very thankful for guys

like you kind of creating this

kind of stuff for us to kind of

channel our stress out, you know

, to kind of talk about it.

Closing words I think I'm

positive about the future.

I very am.

I think the next five years uh

is going to be reverse of the

past five years, especially in

hong kong.

You had protests, all that kind

of stuff, and you had covids uh

and then you had uh rates being

high.

So I think next five years,

awesome, enjoy the ride, thank

you.

Jonathan Nguyen: I think we

certainly will Pak thank you

very much for your time and I

look forward to getting you back

in a year's time and get an

update see where you are.

Whether you've retired to the

Bahamas or whether you're still

in the depths of Indonesia

trying to decode the next

language.

Pak-Sun Ting: In the trenches,

but I'll be happy to come back

again, for sure.

Jonathan Nguyen: Awesome, Thanks

Pak.

Pak-Sun Ting: Thank you.

Thank you, Jonathan.