Send us a textThe funding environment is tough, but there is precedence. This episode’s guest, John D. Evans, CFA founder and general manager of SEIML Ventures, spent over 24 years as an investment banker, 12 years as a professor of practice, and 7 years in corporate finance. He's seen the highs and lows, booms and busts, of various economic cycles, making him a wealth of knowledge. With his unique insights, we explore the tough competitive nature of markets and the struggle startups face to ...

Show Notes

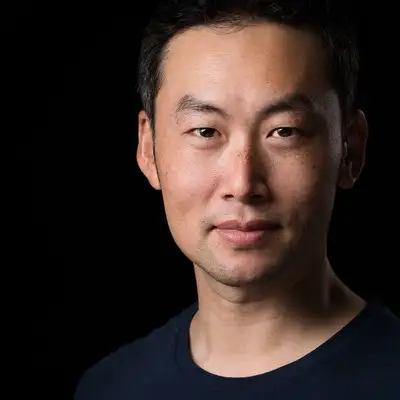

The funding environment is tough, but there is precedence. This episode’s guest, John D. Evans, CFA founder and general manager of SEIML Ventures, spent over 24 years as an investment banker, 12 years as a professor of practice, and 7 years in corporate finance. He's seen the highs and lows, booms and busts, of various economic cycles, making him a wealth of knowledge. With his unique insights, we explore the tough competitive nature of markets and the struggle startups face to generate revenue. Ever wondered how similar government-backed currency and private cryptocurrency markets are? We navigate that too!

Expanding our fiscal exploration, we peer into the darker side of finance, examining the history of financial fraud and its prevalence in boom and bust markets. You might be surprised by the similarities between Bernie Madoff and Bankman-Fried, and the distinct risks linked to neo banks and single-purpose fintechs. We also discuss the often-overlooked hurdle startups face: being able to commercialise. It's not all about the idea, it's about distribution and market demand.

If you're considering launching a fintech in Asia, you'll definitely want to hear about the FinTech ASEAN program, an all inclusive startup training program. Get ready to uncover the fascinating, complex, and often tumultuous world of finance and entrepreneurship.

Subscribe to our YouTube channel for more interviews, investor insights, and pitch deck tips.

Visit our website to learn more about our work with Asia's leading tech startups.

Creators and Guests

What is Unsensible - The Asian Startup Podcast?

BRAVE SOULS WANTED.

Failure almost certain. Attempting is unwise.

Far east adventure. Success is changing the world.

Join us on the Unsensible podcast where we talk to the Asian startups and their ecosystem partners who are intent on changing the world.

Speaker 1: Even if there is a

demand, it's not a guarantee

that you'll make money, because

it's a competitive market out

there.

You need to know how to grow

the business.

You've got to have a good team.

Founders typically come from

the technical side, so they're

maybe not good in marketing,

sales and branding and, of

course, generating revenue.

Generating sales is the first

serious test that you face and

that probably accounts for a

good portion of that 90% who

fail before three years because

they can't commercialize, they

can't generate revenue, they

can't market.

Speaker 2: Welcome back to the

Uncensible Podcast.

Today I've got a special guest,

someone whose name will come up

over the coming weeks and

months.

We've started working very

closely with a gentleman sitting

next to me, john Evans, founder

and general manager of SEIML

Ventures.

John, we've been talking for a

while now, but why don't you

tell everyone else a little bit

about yourself and your very

long work history?

Speaker 1: Thank you, john.

Yeah, I mean.

I started life in the financial

markets in 1980 and spent 24

years as an investment banker in

debt, capital markets, equity

capital markets and investment

advisory, and this was always

dealing with very large publicly

listed companies and government

issuers on the debt side.

Then I went into academia for

12 years, professor of practice

in the UK and China, running

master's programs and investment

management, but in 2016, I

returned to industry, but in a

slightly different way, working

in corporate finance like I

started off, but with new early

stage companies, and so I've

been doing that for about seven

years now, started off in China,

now expanding into Asia, but

I've always done teaching part

time, and so I was very

intrigued when I learned about

the Founder Institute and the

Accelerator Program, which is

really like a training program,

and I thought it was a great way

to get involved with the

industry to help early stage

companies increase their chances

for success because there's a

high failure rate with startup

companies but also help the

investors make better

investments in what is a very

risky part of the investment

strategy.

So it's one line of our business

we provide consulting services

to startups, medium size

enterprises, we assist investors

, but this brings a whole

pipeline of early stage

companies that we can help

either to grow or find funding,

so it was a natural extension to

our business.

Speaker 2: Well, I'm not saying

you're old, but I do see your

gray hairs.

You've probably seen a few

economic cycles, right?

Speaker 1: Yes, I remember

shortly after I started in 1980,

which was a period of high

inflation and Volker, who was

then chair of the Federal

Reserve, raised overnight

interest rates in America to 21%

, which created a huge economic

recession around the world, and

the monstrous bubble of the

lending to LDC-developed

countries like Mexico, brazil

and Argentina created a very

substantial recession that took

about a decade to recover.

So that was my first experience,

really the 10 years after that.

One of the consequences of the

fallouts of that was that the

banking industry was seriously

hurt in the 1982 banking crash,

and so the development of

securities markets filled the

gap for the less ability for

banks to finance the world's

economy.

And so I got in at the very

early stages, working with UBS

at the time of the whole

explosion of the Euro bond

market and later the Euro equity

market.

So it was a fascinating time.

And then there's been many

other cycles at the end of the

90s, the Asian crisis, the

currency and things like that

followed shortly after in March

2000 with the dot-com crash,

with the 2008 financial markets

crash, and you could say we're

perhaps entering a bit of a

crash as they take away the QE

bubble.

So there's been no shortage of

excitement along the way.

Speaker 2: Yeah, I mean, are you

seeing we've had some very

colorful characters in the

markets of late, sam

Bankman-Fried CZ from Binance.

These characters, humans being

humans, have must have.

You've seen versions of them

before, surely?

Speaker 1: Yeah, I mean people

are very focused now on

Bankman-Fried crypto problems

and court cases and indictments

going on, but I think one

important thing to realize is

that when you're talking about

the financial industry, whether

you're talking about a

government backed currency or

whether you're talking about a

cryptocurrency which is a

privately backed, the whole

system of financial management

is really the same.

You're just talking about a

different underlying asset, and

so all of the problems that have

come up more recently, which

relate to issues about safe

custody, settling, security,

reconciliation, separation of

client funds from company funds

that have been a really big part

of the Bankman-Fried court

cases they're really just the

same thing that happened before

within financial institutions,

so there's a lot of similarities

.

It's just the location changes

over time.

Speaker 2: And with

Bankman-Fried I mean before him.

There was made-off right.

Speaker 1: There's been a whole

line, or you can go back to the

fellow who is running the fund

for bearings asset management in

the late 90s.

So it seems like every decade,

perhaps coincidental with the

cycle, you find some really big

fraud.

It was Bankman-Fried.

Now it was Bernie made-off in

2008.

It was the guy at bearings in

sort of 97, 98.

They come and go, probably with

the collapse of or the downturn

in the economy.

That's like the old economist

John Kenneth Galbraith talked

about in the term the bezel.

All of these serious problems

are not found out in boom times,

when markets are going up and

everyone's happy and no one

needs to get their money back.

But when the market turns south

, like it did when they started

jacking up interest rates and

ending QE and people then need

to get their money back, then

they find a lot of times they

can't get their money back and

all of these frauds come to the

surface and that's usually when

they're found out when markets

turn south.

Speaker 2: I feel like made-off

was a bit of a was a much more

calculating and smoother

criminal.

Perhaps he wasn't as flamboyant

as Bankman-Fried.

He actually kept two sets of

books, whereas I think in the

investigation so far

Bayman-Fried really didn't keep

books there.

She didn't know where the money

was.

Speaker 1: Yeah, I mean,

whenever you compare something,

you can find similarities and

you can find differences.

Certainly, madoff attempted to

keep a low public profile,

whereas Bankman-Fried tended to

be quite extravagant he was on

the cover of Forbes magazine.

So you know, if you're doing

something seriously long wrong

on a large scale, probably

drawing a lot of public

attention to yourself might not

be the best long-term strategy.

So that's one big difference

between the two.

Speaker 2: So now we're seeing a

proliferation of fintechs.

This is the current buzzword.

We've got lots of startups

setting up in this space One in

the spectrum, you know, startups

that want to become banks

neo-banks, as they call them.

And then you've got, you know,

single-purpose startups, maybe

focused on a very small part of

the payment system.

With all of these, this range,

do you think we're getting

saturated?

Is there?

Are there too many startups now

?

Speaker 1: I think you see every

decade in the financial

industry a common trend where

there's a lot of expansion and

then there's consolidation.

Over the last 10 years, or sort

of post-2009, where we've had

the quantitative easing bubble,

there was so much cash, it was

easy to start companies in any

industry not just in the

financial industry and a lot

exploded because private capital

, venture capital, was so easy

to come by.

Those days are over, and so I

think we're going to see

consolidation.

I think that's also always the

case in the financial industry,

because it really is a market

that's dominated by large

one-stop financial institutions,

and so it's very hard to

survive as a single provider of

some financial service.

Usually, sooner or later they

get bought up by a full-service

bank.

So the single-purpose providers,

I think, are here for a long

time because there's a lot of

legacy systems, there's a lot of

inefficiencies that can be

intermediated or disrupted by

new fintech.

So I think there's a lot of

opportunity.

But I think the longer-term

prospects for these

single-purpose fintechs is to be

acquired by some much bigger

financial institutions.

I think the NEO banks are a

slightly different story,

because it's really very

difficult to start a new bank.

I mean, it's not just the issue

that there's so many

established banks and thus a lot

of competition out there.

But banking is an industry that

operates on high leverage, and

so if you enter the industry,

even as a small entrant, you

have to work on that leverage,

otherwise you can never be

profitable.

But you only ever keep a small

percentage of your deposits on

hand, so if there's ever a loss

of confidence in the market or

your institution, then you can

fail very, very quickly.

Speaker 2: You saw that with

Silicon Valley Bank right.

Speaker 1: Yeah, which wasn't

exactly a startup, but it

emphasizes the point that if

there's a loss of confidence,

banks can fail very, very

quickly.

So I'm a little less bullish on

the NEO banks, as I are on the

single providers, because I

think they're in a very risky

position.

If they can develop some sort

of really different and

effective internet bank, they

might be acquired by a big bank

that has been unable to develop

it, but I think that's a very

risky area, whereas I think the

single payment or the single

service providers have a good

future, because there's still

lots of opportunity to improve

the efficiency and effectiveness

of the capital markets, even if

you're gonna be bought out

longer term.

Speaker 2: It's interesting

because we spoke earlier and if

you take a view of a single

market, if you look at, if

you're just in Singapore, you

might say that well, the banks

are so innovative, the payment

systems all linked.

What is there left to improve?

Speaker 1: Yeah, and I think the

public only sees the surface of

the financial industry, I mean

in the courses we run in

financial markets operations,

how the sort of internal

plumbing of the financial system

works.

To the outside user it may seem

very up to date, but maybe in

terms of the settlements, the

custody, the processing, they're

using legacy systems that are

maybe very slow.

Probably there's still not

efficient and effective

connection between institutions.

So I think when you get behind

the surface of financial it's a

lot less modern than it may

appear on the surface.

Speaker 2: Especially if you

start getting into the national

banks, the reserve banks.

Speaker 1: Yeah, I mean by

nature.

The bigger you are, the longer

you've been around, the bigger

and more legacy systems you will

have, and the larger it is to

change.

I mean a classic example it's

not a private bank, it's the

Federal Reserve Bank and the US

Treasury management of the US

Treasuries, which is the largest

debt market in the whole world.

I mean, for decades they stuck

with fractional pricing 130

seconds, 164, 128th and the rest

of the world had all gone to

decimal.

And they thought why is the

world's biggest capital market

not going to decimal?

Because the costs of the system

, because the system was so big

and so interlinked with

everything, was just too great.

And so that, to me, is a good

example of how, if you're too

big to change, then the latest

developments can be very late

coming, and so vested interests,

legacy systems, can often be a

big barrier to change.

Speaker 2: And then we can't

talk about opportunities without

talking about the risks.

Certainly, there are

opportunities everywhere, but

there's also risks, and for

founders and for investors.

We can see situations where

innovation outpaces legislation.

So if you look at Coinbase,

unlike their peers that have

possibly been a little bit gray,

they've tried to actively

engage with regulators, but

they're still very recently

being dinged.

What do you think about this as

a risk?

Legislative risk always follows

and always follows the

innovation, not the other way

around.

Speaker 1: Yeah, I mean I think

there's a public policy question

because, by definition,

governments are not centers of

innovation.

With very rare exceptions, it

tends to come from private

sector competitive markets.

And so, firstly, you have, as a

government, a public policy

choice.

Do you want to encourage

innovation, which means you get

the good parts of it and you get

the risks with it?

You know every distribution has

a right tail and a left tail.

We all want the right tail, but

if you want a right tail you've

got to take some of the left

tail with it.

If you're not prepared to

follow or to be exposed to those

risks, then you are limiting

innovation.

And as we teach in investment

management, if you want a higher

expected return you have to

take a higher level of risk.

The other thing is, in many

markets there's not a good

connect between government

regulators and private sectors

for a variety of different

reasons.

Sometimes they feel there'll be

conflicts of interest if

there's movements quickly back

and forth between the two

sectors.

But if you don't have some sort

of really effective mechanism

for integration and knowledge

interchange, then that delay in

proper regulation will be even

greater to the innovation.

Speaker 2: So there's a lot of

questions there at the high

level, government level, I mean,

during the crypto bubble, a lot

of retail investors got very

excited and lost their shirts.

Then you had some investors who

were probably a little bit more

cautious and said well, I want

to be part of the crypto boom,

I'll put my money into Coinbase,

because they seem to be.

They're listed, they follow

their reports, they're engaging

with regulators.

They're still probably going to

lose their shirts.

There is a lot of upside to

investing in these fintechs,

whereas downside, aside from the

risk to founders, how do

investors protect themselves?

Speaker 1: I think to take one

step back.

One of the big failings we have

almost everywhere not just in

any one jurisdiction is not

providing good basic education

for people to invest.

I mean, whether you're

investing in crypto or whether

you're investing in a listed

stock on the New York Stock

Exchange, the approach that you

take is fundamentally the same.

You're just looking at

something different, a different

company or a different product,

but you think of all the people

you went through high school

with, or maybe even university.

Unless they took a specialized

financial course, they probably

don't know how to do due

diligence.

They make an informed

investment decision.

They tend to just follow trends

.

Education in the market is a

really big issue.

Speaker 2: In the Founder

Institute program I guess the

standard program you're adding

additional modules, right yeah,

Can you tell us a bit more about

the modules you're gonna be

adding to that program?

Speaker 1: You know, I have a

separate course and of

entrepreneurship, and on the

first day we have one section

called Every company is two

companies, and what that means

is that you have an industry or

a specialization.

You're in healthcare, you're in

fintech, you're in blockchain,

whatever.

That's your industry, that's

your subject matter,

specialization.

But every company also has to

have a business administration,

manage the commercialization,

managing the marketing, generate

revenue.

So there's those two aspects to

every company.

So the core program of the

Founders Institute basically

helps the companies manage the

business side, the business

growth, how to market, how to

make pitches to prospective

customers.

It focuses really on the

business administration side,

but it doesn't provide

specialist knowledge, and so, as

I have a background, I thought

we would supplement it by four

additional modules that dealt

with financial markets,

financial products and financial

markets operations, to give

some of that specialist subject

matter knowledge to the founders

, many of whom probably come

from a technology background and

have never worked in financial

markets, and so to understand

how they really need to put this

together, to speak

knowledgeably to big financial

institutions they may want to

partner with, they need to have

that specialist knowledge.

And also the investors that

come along that may look at

these company.

They need to have those as well

.

So we're trying to supplement a

core program which focuses on

the business development with

subject matter expertise in

financial markets and financial

markets operations.

Speaker 2: Let's go back to the

startup side of things and most

of these startups will fail

within three years, like 90%,

huge failure rate.

Speaker 1: There's a lot of

people who have ideas that are

actually viable ideas, but they

don't know how to commercialize

them.

They're lacking the training,

and that's really what the

benefit or the intention of the

founders Institute program is is

to find those people with a

good idea but who need help to

convert it into a successful

business.

So they become the 40% of the

graduates, not the 60% of the

ones that fail out.

So just a lot of lack of

ability to convert a good idea

into a commercialized area.

That's a big part of the

problem.

A lot of people who come from a

research background maybe

because they're taking a PhD in

biomedicine at a university they

become fascinated on their area

of research and they know it

better than maybe anyone else on

the planet and they say, okay,

I'm the expert, I'm gonna

commercialize this, but there's

no market for it.

I remember the first case study

I took in my MBA was it was

called Building the World's Best

Mousetrap and it was all about

these people who were determined

to build the best mousetrap,

put time and effort into it and

they had the product.

They spent money but nobody

wanted it.

So it's a combination of so

many people have really good

ideas but they don't test out

whether there's a market demand

for it, because you have to if

you want to stay in the private

sector, which is what we're

talking about in startup

companies make this company

financially viable.

There's got to be a demand.

Even if there is a demand, it's

not a guarantee that you'll

make money, because it's a

competitive market out there.

You need to know how to grow

the business.

You got to have a good team.

Founders typically come from

the technical side, so they're

maybe not good in marketing,

sales and branding and, of

course, generating revenue.

Generating sales is the first

serious test that you face and

that's probably accounts for a

good portion of that 90% who

fail before three years because

they can't commercialize, they

can't generate revenue, they

can't market.

So there's a lot of variables.

Speaker 2: Yeah, my favorite

quote from an exited founder,

justin Khan, who was the founder

of Twitch.

He says first-time founders

worry about product, second-time

founders worry about

distribution.

Yeah, yeah, there's no true

words were spoken.

So we've been a wild ride, john

.

We've had made-off, we've had

SPF investment risk

opportunities.

Let's bring it all back

together for founders and

investors.

We were running the FinTech

ASEAN program.

Tell us a little bit more about

that.

Speaker 1: Okay, firstly, just

the details.

Registration will be open until

the 20th of August for any

founder that is interested in

joining the program, and it's

not just for companies that are

located in Asia.

Any company that would be

interested in perhaps entering

the Asian market is welcome to

join.

There's no geographic

restrictions on who might who

can join, and the program kicks

off on the 4th of September,

runs for 14 consecutive Tuesdays

.

The four supplementary sessions

about financial markets and

financial markets operations

will be on 4th Thursdays over

that 14 week period and it will

all wrap up before the end of

December.

And we it's part of our

ecosystem.

I mean we provide consulting

and advice to five mid-tech,

fintech, medium-sized

enterprises that are all

entering the ASEAN market for

the first time.

They're interested in finding

good startups to work with

because it may supplement their

product line.

So they've developed very

successful strategies of working

with startups in America and

Europe and we hope to replicate

that, and so that might be an

added benefit to a founder that

takes the program.

Maybe there is someone there

that will be their, their first

partner or their first customer,

and that's the connect there.

We also are working with a

number of angel investors in one

large venture capital fund from

Palo Alto who's looking at Asia

for the first time.

So we want to assist the

investors by not only helping

companies to be more successful,

but getting to know them and to

allow for a more effective due

diligence process.

Everyone benefits when, when

you know the companies and you

know the investors well.

So we we think that the startup

which will go through the

accelerator is a great way for

us to get to know those

companies, to help them build

their relationships with the

FinTech enterprises or the

FinTech investors, and sort of

everyone wins in that triangle.

Speaker 2: That's great, so I

will put the link to sign up in

the description below.

If you're listening on audio

only, we shall put the link up

on our website and I'll put that

in the show notes.

But, john, thanks so much for

your time today.

Speaker 1: Thank you very much,

Jonathan.

It's it's a new venture.

It's a very important thing

because I've always been

involved with training, so this

will be my first time focusing

on ASEAN, which I think is an

area with just a huge amount of

opportunity, so I'm I'm really

excited in moving it forward.

Speaker 2: See you next time.